Options

A guide to the financing options in the UK market, viewed from the borrower’s perspective.

The mechanics and risks of each option are described, with explanations of how the risks can be managed.

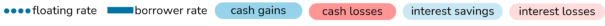

A guide to floating rates. The official UK floating rate benchmarks are Base Rate and SONIA.

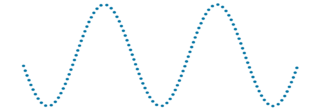

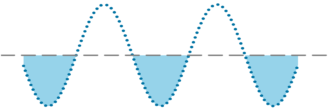

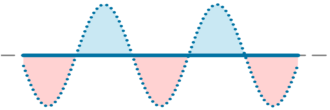

The mechanics and risks of interest rate caps. Caps insure borrowers against high floating rates.

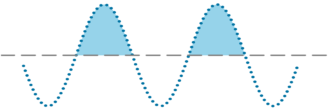

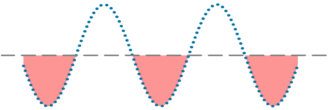

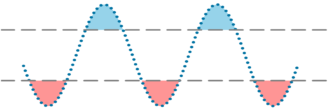

The mechanics and risks of interest rate floors. Favourable floors offset adverse floors.

The mechanics and risks of the adverse floors contained in fixed rate loans, swaps and collars.

The borrower pays the floating rate or the floor rate, whichever is the more expensive.

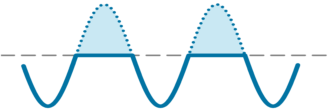

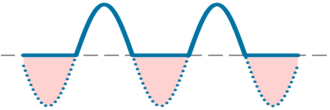

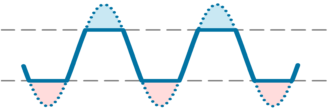

The mechanics and risks of interest rate swaps. A swap combines a cap in the borrower’s favour with an adverse floor.

The mechanics and risks of fixed rate loans. A fixed rate loan equates to a floating rate loan with a cap in the borrower’s favour and an adverse floor.

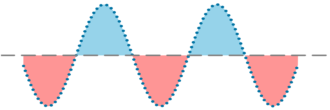

The mechanics and risks of interest rate collars. A collar combines a cap in the borrower’s favour with an adverse floor.

The mechanics and risks of collared loans. A collared loan is a floating rate loan with a cap in the borrower’s favour and an adverse floor.