What is an interest rate collar?

Cap with adverse floor

An interest rate collar combines an interest rate cap in the borrower’s favour with an interest rate floor adverse to the borrower.

Collars are typically purchased by borrowers with floating rate loans, to protect against the possibility of interest rates rising above a chosen maximum, the collar cap rate.

The borrower pays a premium for the cap protection and receives an offsetting premium by selling an interest rate floor. The borrower effectively pays for the interest rate cap by simultaneously selling the interest rate floor. Collars are often structured such that the cap and floor premium payments cancel one another out.

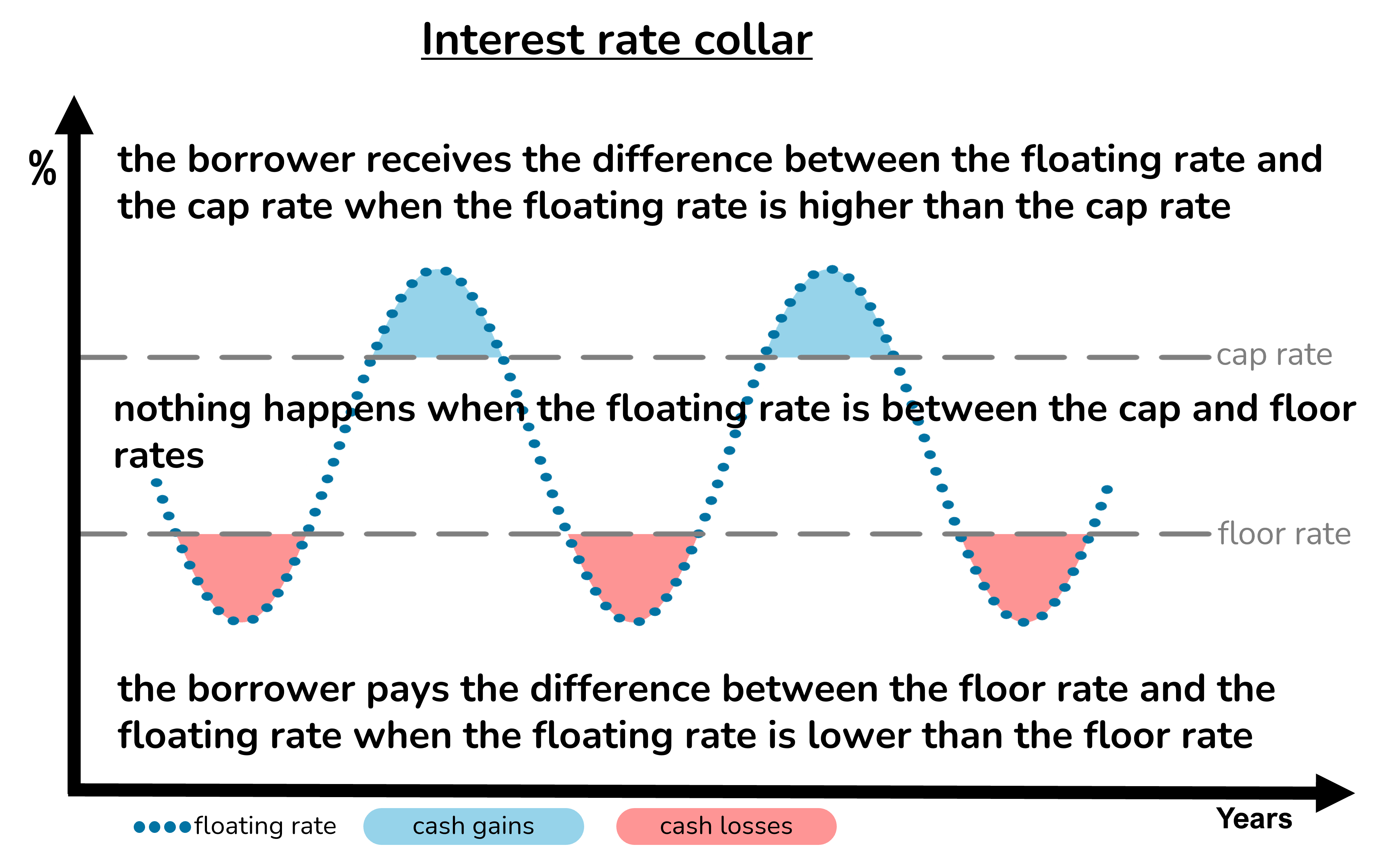

Payments during the life of a collar are as follows:

When the floating rate is between the cap and floor rates of the collar, no payment is made either way.

When the floating rate is above the collar cap rate, the borrower receives payments under the collar. The further that interest rates rise above the cap rate, the larger the payments received by the borrower.

When the floating rate is below the collar floor rate, the borrower makes payments under the collar. The further that interest rates fall below the floor rate, the larger the payments made by the borrower.

The cap element protects the borrower if interest rates rise. But the adverse floor element exposes the borrower to risks if interest rates fall.

The risk of the collar is that, if interest rates fall, the borrower may become trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs.

The adverse floor element of the collar may also impact the borrower’s loan-to-value position.

How is the collar premium paid?

Upfront or in instalments

A collar comprises a cap in favour of the borrower offset by a floor in favour of the lender.

The premium payable by the borrower for the cap protection is offset by the premium payable by the lender for the floor element. Collars are often structured such that the initial premium payments cancel one another out.

If there is a net premium payable for the collar, this is normally paid upfront by the borrower. This is generally the case when the collar is purchased independently of the loan or loans it is hedging.

Some lenders offer deferred premium collars, where the premium is payable in instalments over the life of the collar regardless of what happens to interest rates. By deferring the premium payable, the lender is effectively lending the borrower the money to pay the collar premium so will apply a funding charge and may require additional security.

How are collars priced?

Factors influencing the collar premium

The net premium of a collar is normally expressed as a percentage of the amount hedged and is mainly determined by the collar cap rate and the collar floor rate.

Cap rate: the lower the collar cap rate, the greater the probability that the borrower will receive payments under the cap element of the collar (and the larger each payment will be). Other things being equal, collars with lower cap rates tend to increase the net premium payable by the borrower (or reduce the net premium payable to the borrower).

Floor rate: the lower the collar floor rate, the lower the probability that the borrower will make payments under the floor element (and the smaller each payment will be). Other things being equal, collars with lower floor rates tend to reduce the net premium payable by the borrower (or increase the net premium payable to the borrower).

Amount protected: the net premium for a collar varies in proportion with the amount of loan it is hedging.

For a given collar structure (amount protected, duration, cap and floor rates) the net premium for the collar will fluctuate over time based on changes in market expectations regarding the future path of interest rates and interest rate volatility.

What are the risks of collars?

Break costs and contingent liabilities

Interest rate collars expose borrowers to risks.

If interest rates fall, the borrower may become trapped in an expensive arrangement. The borrower may find it difficult to exit the collar without incurring break costs.

The break costs of collars can potentially be substantial as a percentage of the amount hedged.

The adverse floor element of the collar may also impact the borrower’s loan-to-value position. The contingent liability created by the potential break cost of the collar effectively adds to the amount being borrowed.

In some circumstances the contingent liability can lead to breaches of loan-to-value covenants and place the borrower in default of their loan obligations.

How to manage the risks of a collar?

With a favourable floor

The risks of an interest rate collar can be managed with a favourable floor.

A favourable floor protects its owner against falling interest rates.

The floor owner receives extra income when the floating rate is lower than the floor rate. The further the floating rate falls below the floor rate, the greater the extra income from the floor.

The floor income offsets the losses incurred by borrowers with interest rate collars.

The favourable floor also tends to appreciate in value when floating rates fall. Increases to the value of the beneficial floor offset the increased contingent liability created by the adverse floor contained in the collar.