What is an adverse floor?

The borrower risks losses if rates fall

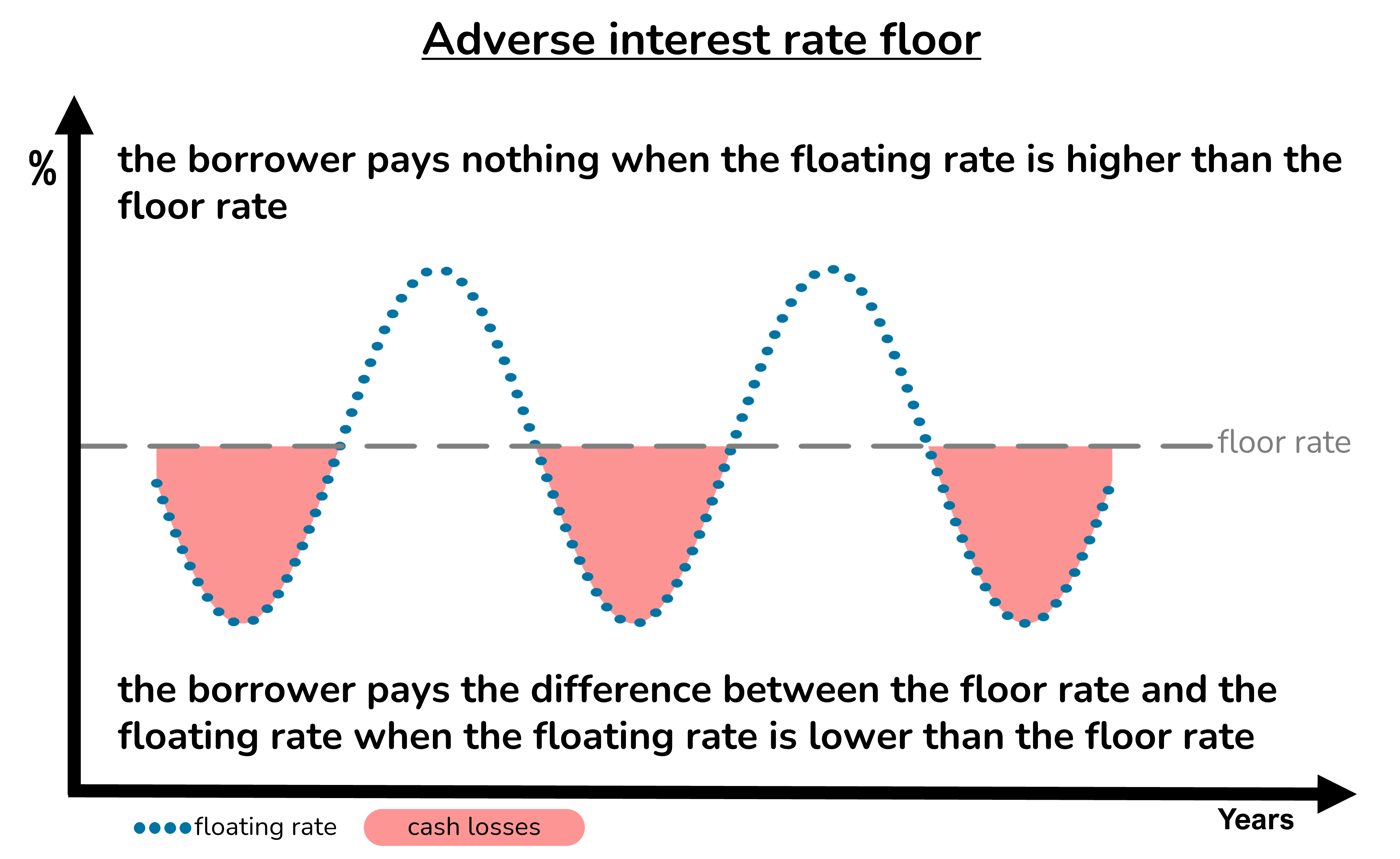

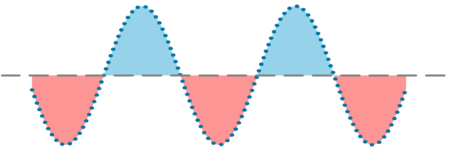

An adverse floor obliges the borrower to make payments whenever the floating rate falls below a specified minimum, the floor rate. The further that the floating rate falls below the floor rate, the larger the payments made by the borrower.

Borrowers become exposed to adverse floors when they enter interest rate collars and swaps or fixed rate loans. In these cases, the borrower effectively pays for an interest rate cap by simultaneously selling an adverse interest rate floor.

The cap protects the borrower if interest rates rise. But the adverse floor exposes the borrower to risks if interest rates fall.

Some floating rate loans contain an adverse floor without a cap. The floor may take the form of a minimum interest rate payable by the borrower.

The risk of an adverse floor is that, if interest rates fall, the borrower may become trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs.

An adverse floor may also impact a borrower’s loan-to-value position.

Which products expose borrowers to adverse floors?

Collars, swaps and fixed rate loans

Borrowers become exposed to the risks of adverse floors when they enter interest rate collars and swaps and when they take out collared or fixed rate loans.

In each case the borrower effectively pays for an interest rate cap by simultaneously selling an interest rate floor. The cap protects the borrower if interest rates rise. But the adverse floor exposes the borrower to risks if interest rates fall.

The risk of these products is that, if interest rates fall, the borrower may become trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs. An adverse floor may also impact a borrower’s loan-to-value position.

Interest rate collars

An interest rate collar combines a cap in the borrower’s favour with an adverse floor.

When the floating rate is between the cap and floor rates of the collar, no payment is made either way.

When the floating rate is above the collar cap rate, the borrower receives payments under the collar. The further that interest rates rise above the cap rate, the larger the payments received by the borrower.

When the floating rate is below the collar floor rate, the borrower makes payments under the collar. The further that interest rates fall below the floor rate, the larger the payments made by the borrower.

The borrower effectively pays for the interest rate cap by simultaneously selling the interest rate floor. The cap protects the borrower if interest rates rise. But the adverse floor exposes the borrower to risks if interest rates fall.

The risk of the collar is that, if interest rates fall, the borrower may become trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs. The adverse floor may also impact the borrower’s loan-to-value position.

Interest rate swaps

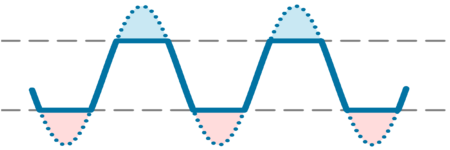

A swap is analogous to a collar with its cap and floor rates set at the same level, the swap rate.

When the floating rate is higher than the swap rate, the borrower receives payments under the swap as the result of the interest rate cap element. The further that the floating rate exceeds the swap rate, the greater the payments received by the borrower.

When the floating rate is lower than the swap rate, the borrower makes payments under the swap as the result of the adverse floor element. The further the floating rate falls below the swap rate, the greater the payments made by the borrower.

The borrower effectively pays for the cap element of the swap by simultaneously selling the adverse floor. The cap protects the borrower if interest rates rise. But the adverse floor exposes the borrower to risks if interest rates fall.

The risk of the swap is that, if interest rates fall, the borrower may become trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs. The adverse floor may also impact the borrower’s loan-to-value position.

Collared loans

A collared loan is a floating rate loan with an embedded interest rate collar.

When the floating rate is between the cap and floor rates of the collar, the borrower pays the floating rate.

When the floating rate is above the cap rate, the borrower pays the cap rate, saving money compared to the floating rate as the result of the embedded cap.

When the floating rate is below the floor rate, the borrower pays the floor rate, losing money compared to the floating rate as the result of the embedded floor.

The borrower effectively pays for the embedded interest rate cap by simultaneously selling the embedded interest rate floor. The cap protects the borrower if interest rates rise. But the adverse floor exposes the borrower to risks if interest rates fall.

The risk of the collared loan is that, if interest rates fall, the borrower may become trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs. The adverse floor may also impact the borrower’s loan-to-value position.

Fixed rate loans

A fixed rate loan is equivalent to a floating rate loan with an embedded cap and adverse floor.

When the floating rate is higher than the fixed rate, the fixed rate borrower makes interest savings as the result of the embedded cap. The further the floating rate exceeds the fixed rate, the greater the interest savings made by the borrower.

When the floating rate is lower than the fixed rate, the fixed rate borrower incurs interest losses as the result of the embedded adverse floor. The further the floating rate falls below the fixed rate, the greater the interest losses incurred by the borrower.

The borrower effectively pays for the embedded cap by simultaneously selling the adverse floor. The cap protects the borrower if interest rates rise. But the adverse floor exposes the borrower to risks if interest rates fall.

The risk of the fixed rate loan is that, if interest rates fall, the borrower may become trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs. The adverse floor may also impact the borrower’s loan-to-value position.

What are the risks of adverse floors?

Break costs and contingent liabilities

Products containing adverse floors expose borrowers to risks.

If interest rates fall, the borrower may become trapped in an expensive arrangement. The borrower may find it difficult to exit the arrangement without incurring break costs.

The break costs of collars, swaps and fixed rate loans can potentially be substantial as a percentage of the amount borrowed.

The adverse floor may also impact the borrower’s loan-to-value position. The contingent liability created by the potential break cost effectively adds to the amount being borrowed.

In some circumstances the contingent liability can lead to breaches of loan-to-value covenants and place the borrower in default of their loan obligations.

How can the risks of adverse floors be managed?

With favourable floors

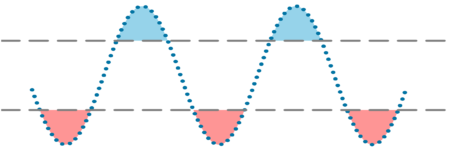

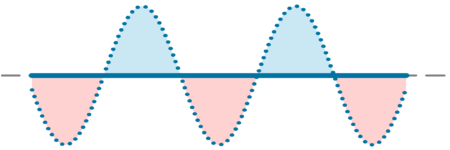

The risks of an adverse floor can be managed with a floor in favour of the borrower.

The floor protects the borrower against falling interest rates.

The borrower receives extra income when the floating rate is lower than the floor rate. The further the floating rate falls below the floor rate, the greater the extra income from the floor.

The floor income offsets the losses incurred by borrowers with fixed rate loans, interest rate swaps, interest rate collars and collared loans.

The favourable floor also tends to appreciate in value when floating rates fall. Increases to the value of the beneficial floor offset the increased contingent liabilities created by the adverse floors contained in swaps, collars and fixed rates.