The risks of a floored loan can be managed with a favourable floor.

A favourable floor protects its owner against falling interest rates.

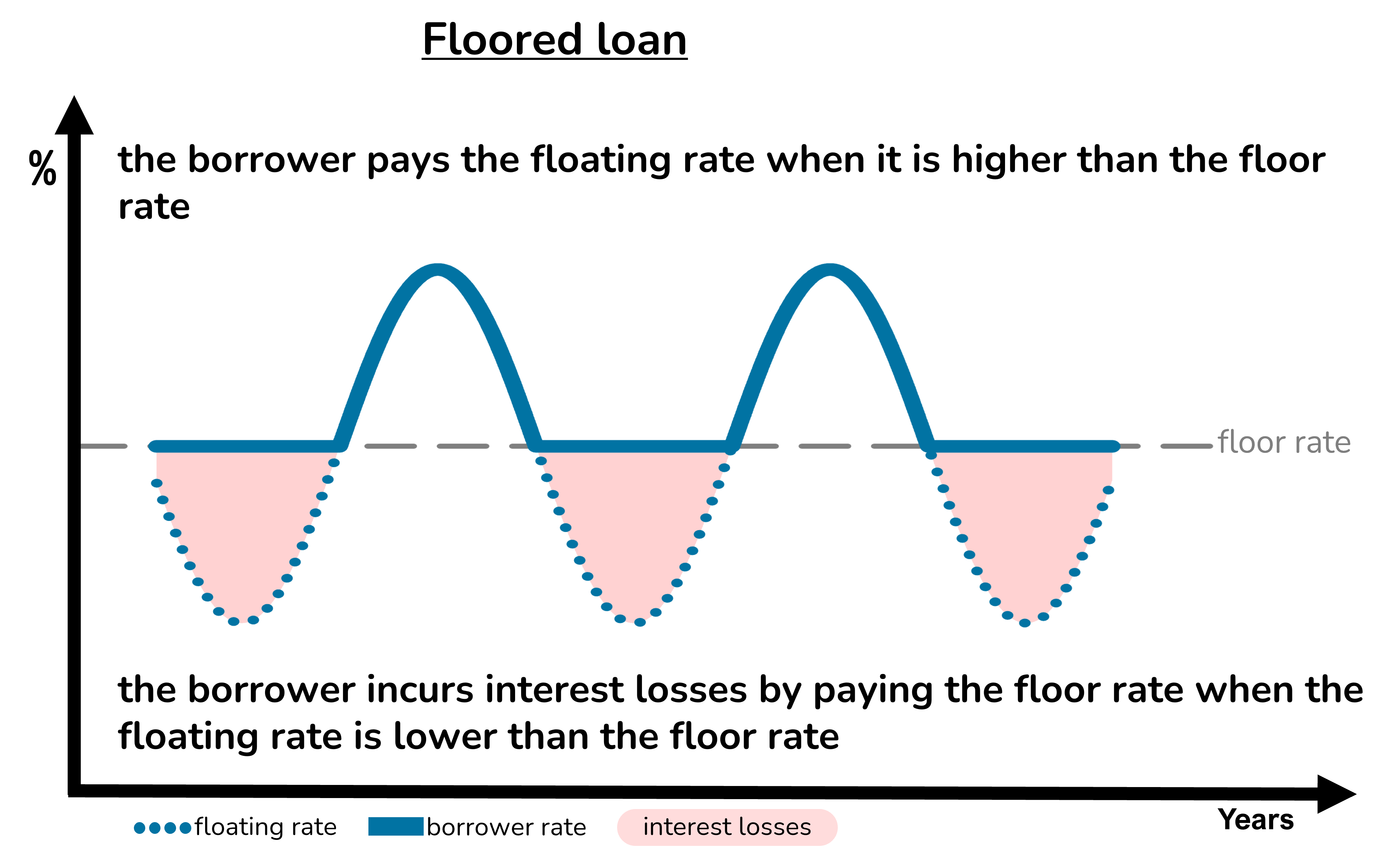

The floor owner receives extra income when the floating rate is lower than the floor rate. The further the floating rate falls below the floor rate, the greater the extra income from the floor.

The floor income offsets the losses incurred by borrowers with floored loans.

The favourable floor also tends to appreciate in value when floating rates fall. Increases to the value of the favourable floor offset the increased contingent liabilities created by the adverse floor embedded in the floored loan.