What is a fixed rate loan?

Cap with adverse floor

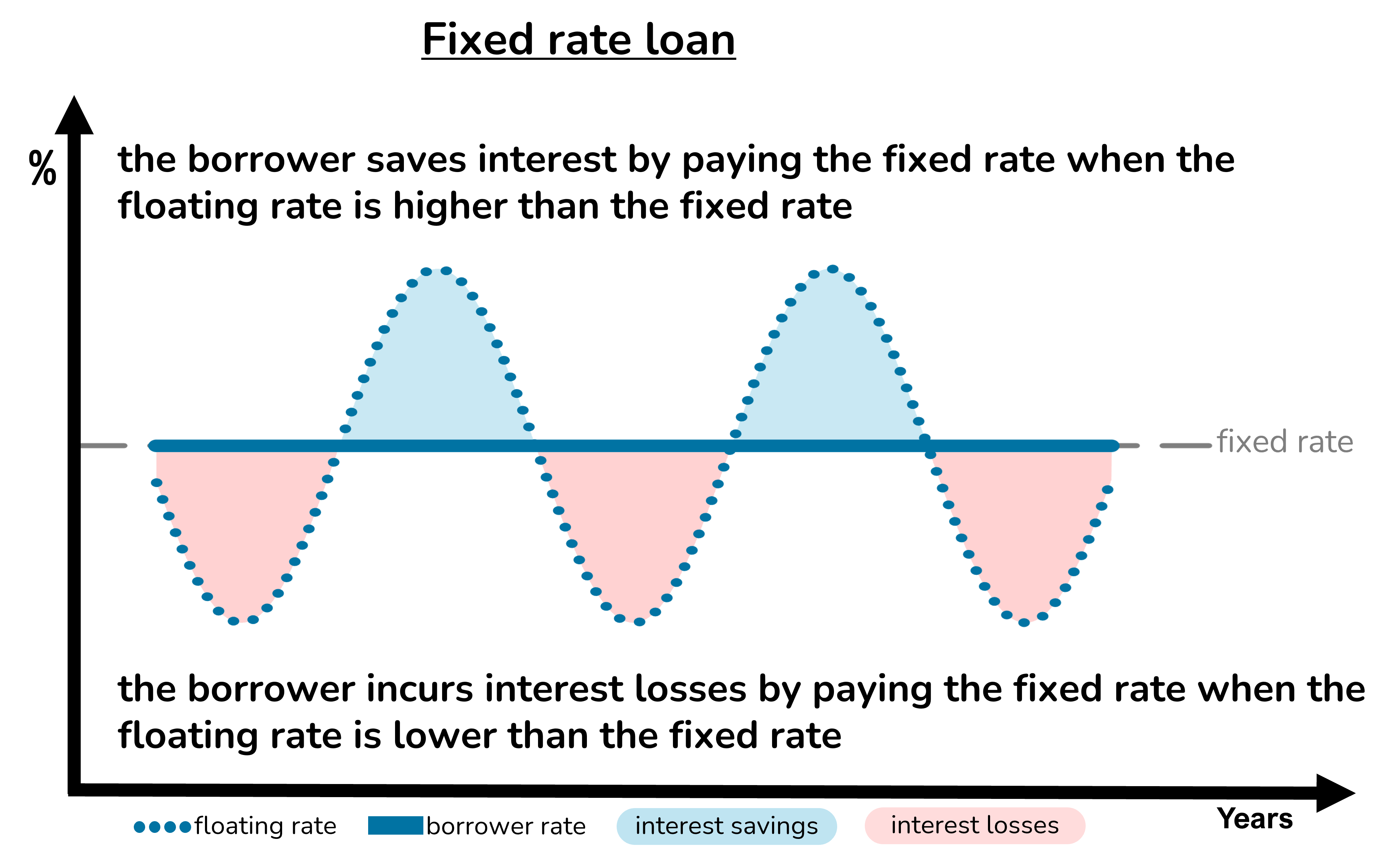

A fixed rate loan is equivalent to a floating rate loan with a cap in favour of the borrower and a floor in favour of the lender.

The borrower’s interest payments remain constant during the life of the loan regardless of the prevailing floating rate.

When the floating rate is higher than the fixed rate, the borrower pays less than the floating rate, making an interest saving due to the cap element. The further the floating rate exceeds the fixed rate, the greater the interest saving made by the borrower.

When the floating rate is lower than the fixed rate, the borrower pays more than the floating rate, incurring an interest loss due to the adverse floor element. The further the floating rate falls below the fixed rate, the greater the interest loss incurred by the borrower.

The borrower effectively pays for the cap by simultaneously selling the floor. There is normally no upfront premium payable for the loan because the cap and floor elements tend to be priced at equal and opposite value.

The cap protects the borrower if interest rates rise. But the adverse floor exposes the borrower to risks if interest rates fall.

The risk of a fixed rate loan is that, if interest rates fall, the borrower may become trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs.

The adverse floor element may also impact the borrower’s loan-to-value position.

How are fixed rate loans priced?

Factors influencing the fixed rate

There are two key factors determining the fixed rate payable by a borrower: the market swap rate and the credit spread applied by the lender.

Market swap rate: the market swap rate is the rate at which the cap and the floor have equal value. The swap rate reflects market expectations regarding the future path of interest rates. Market swap rates for selected maturities are published each business day on the Bank of England’s website.

Credit spread: the credit spread reflects the lender’s required return for its risk in lending money.

The borrower is normally offered a single number representing the fixed rate of the loan. That number incorporates the market swap rate and the credit spread.

For a given fixed rate loan structure (amount, duration and interest payment dates), the fixed rate offered to the borrower will fluctuate over time based on changes in market expectations regarding the future path of interest rates.

What are the risks of fixed rate loans?

Break costs and contingent liabilities

Fixed rate loans expose borrowers to risks.

If interest rates fall, the borrower may become trapped in an expensive arrangement. The borrower may find it difficult to exit the fixed rate loan without incurring break costs.

The break costs of fixed rate loans can potentially be substantial as a percentage of the amount borrowed. The value of the loan fluctuates with reference to market swap rates, which can be volatile.

The adverse floor element of the fixed rate loan may also impact the borrower’s loan-to-value position. The contingent liability created by the potential break cost of the fixed rate loan effectively adds to the amount being borrowed.

In some circumstances the contingent liability can lead to breaches of loan-to-value covenants and place the borrower in default of their loan obligations.

How to manage the risk of a fixed rate loan?

With a favourable floor

The risks of a fixed rate loan can be managed with a favourable floor.

A favourable floor protects its owner against falling interest rates.

The floor owner receives extra income when the floating rate is lower than the floor rate. The further the floating rate falls below the floor rate, the greater the extra income from the floor.

The floor income offsets the losses incurred by borrowers with fixed rate loans.

The favourable floor also tends to appreciate in value when floating rates fall. Increases to the value of the beneficial floor offset the increased contingent liability created by the adverse floor contained in the fixed rate loan.