Interest rate swaps are typically transacted by borrowers with floating rate loans, effectively converting the floating rate loans into fixed rate loans.

A swap combines an interest rate cap in the borrower’s favour with an interest rate floor adverse to the borrower. A swap is analogous to an interest rate collar with its cap and floor rates set at the same level, the swap rate.

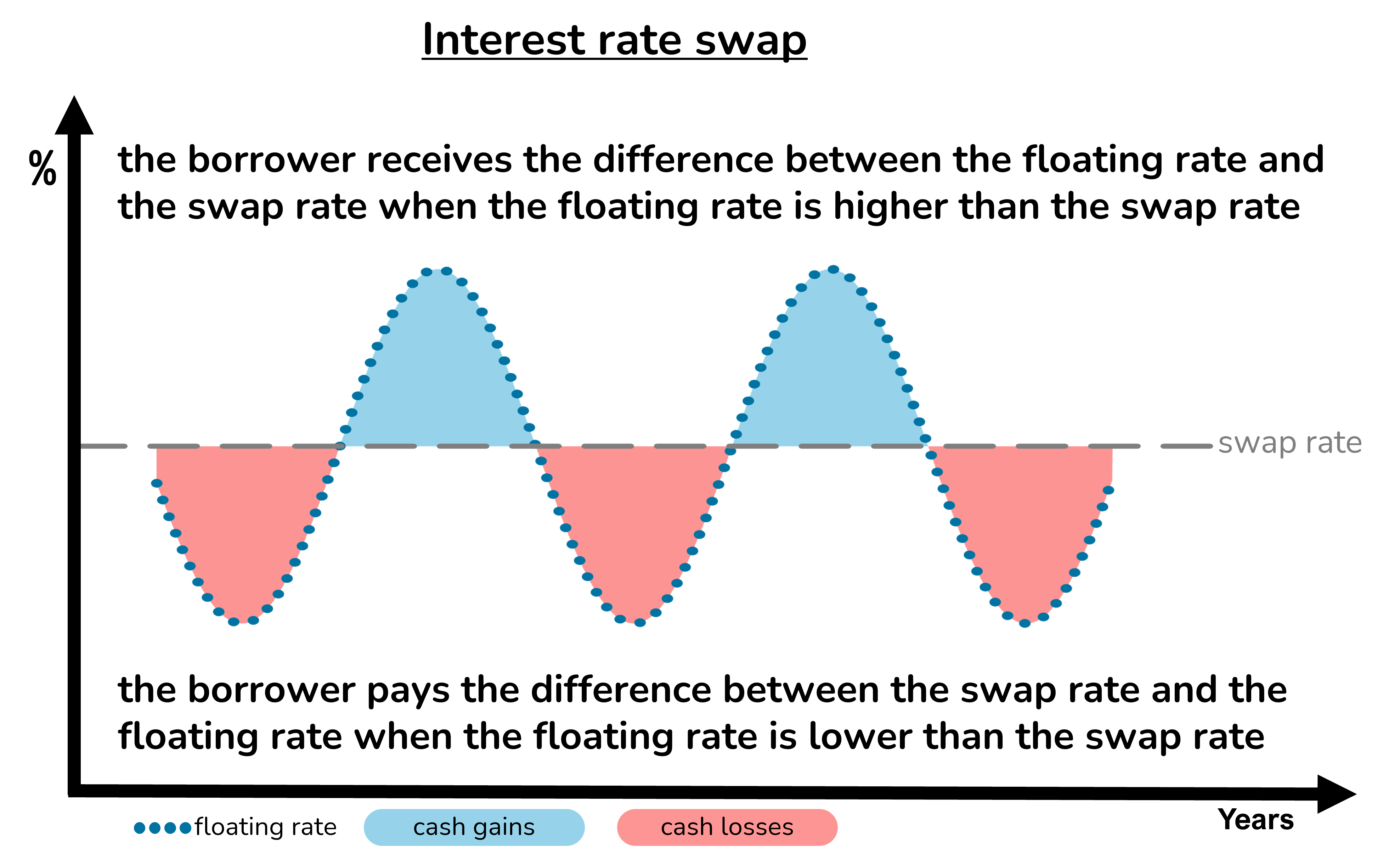

When the floating rate is higher than the swap rate, the borrower receives payments under the swap. The further that the floating rate exceeds the swap rate, the greater the payments received by the borrower.

When the floating rate is lower than the swap rate, the borrower makes payments under the swap. The further the floating rate falls below the swap rate, the greater the payments made by the borrower.

The borrower effectively pays for the interest rate cap element of the swap by simultaneously selling the interest rate floor element. There is generally no upfront premium payable for the swap because the cap and floor elements tend to be priced at equal and opposite value.

The cap element protects the borrower if interest rates rise. But the adverse floor element exposes the borrower to risks if interest rates fall.

The risk of the swap is that, if interest rates fall, the borrower may become trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs.

The adverse floor element of the swap may also impact the borrower’s loan-to-value position.