What is an interest rate cap?

Protection from rising rates

An interest rate cap acts like insurance against high interest rates.

Caps are typically purchased by borrowers with floating rate loans, to protect against the possibility of the floating rate rising above a chosen maximum, the cap rate.

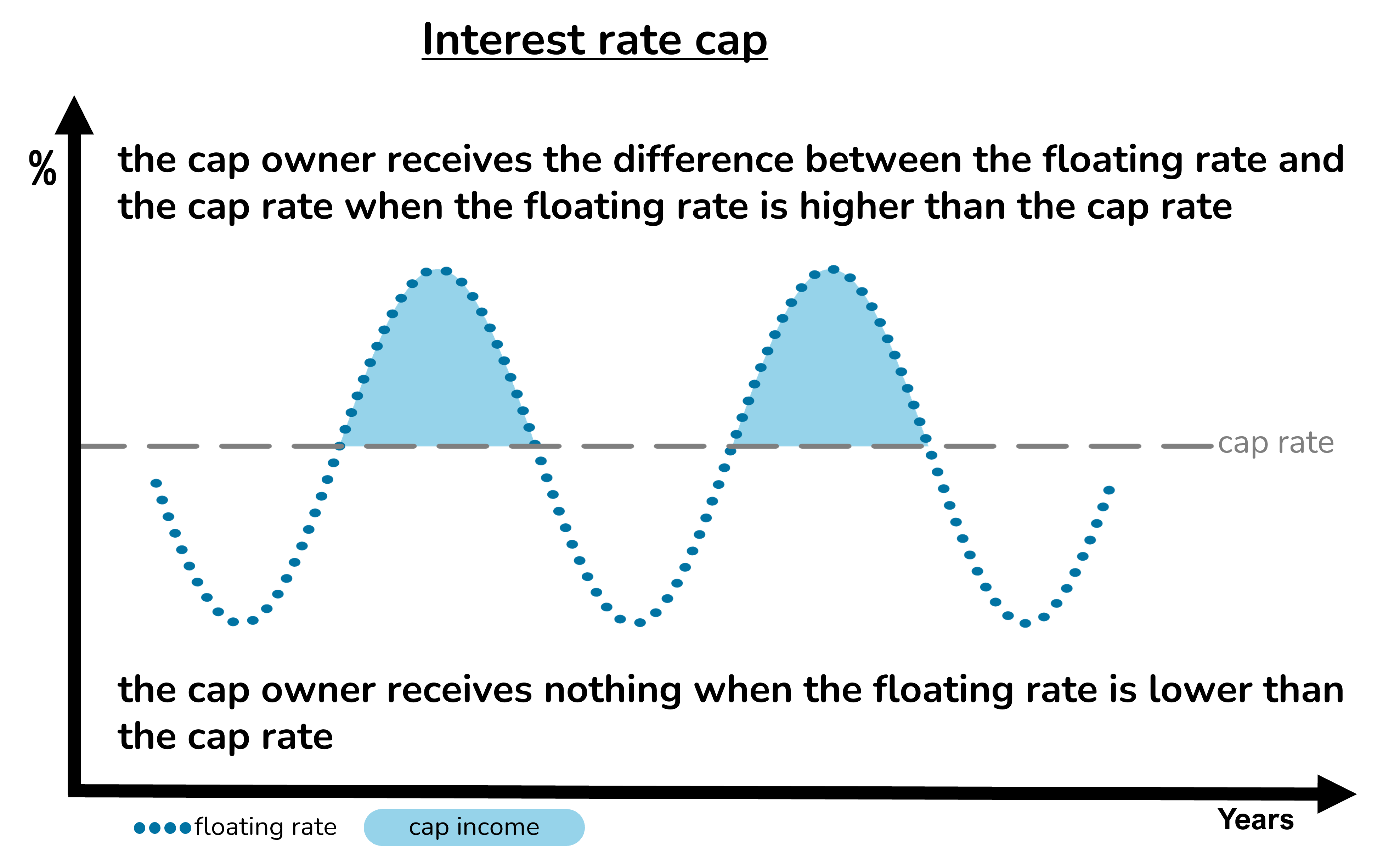

The cap buyer pays a premium for the cap in exchange for extra income whenever the floating rate is higher than the cap rate. The further that the floating rate exceeds the cap rate, the greater the extra income from the cap. The cap income offsets the higher interest cost of the floating rate loan.

When the floating rate is lower than the cap rate, the borrower receives no income from the cap but simply pays the lower floating rate.

Borrowers owning interest rate caps have less risk of being unable to meet loan payments when interest rates rise and are correspondingly better placed to pass lenders’ affordability assessments.

Unlike swaps or fixed rate loans, caps do not expose borrowers to the risks of adverse floors.

The risk of a cap is that the buyer pays a premium for the cap but receives nothing in return, for example if interest rates remain below the cap rate for the duration of the instrument.

How is the cap premium paid?

Upfront or in instalments

The premium for a cap is normally paid upfront by the borrower. This is generally the case when the cap is purchased independently of the loan or loans it is hedging.

Some lenders offer deferred premium caps, where the premium is payable in instalments over the life of the cap regardless of what happens to interest rates. By deferring the premium payable, the lender is effectively lending the cap buyer the money to pay the cap premium so will apply a funding charge and may require additional security.

Borrowers may create their own ‘do-it-yourself’ deferred premium payments by borrowing extra to pay the upfront cap premium cost and then repaying the extra amount borrowed in instalments over the life of the cap.

How are caps priced?

Factors influencing the cap premium

For a given interest rate environment, the amount of the cap premium is driven by three factors, the loan amount protected, the duration of the protection and the cap rate.

Amount protected: the larger the amount being protected, the larger the potential pay-out on the cap. Consequently, the cap premium tends to change in proportion with the amount of loan it is hedging.

Duration: The longer its duration, the more likely that the cap will pay out and the more expensive the cap.

Cap rate: the lower the cap rate, the greater the probability that the cap will pay out (and the larger each payment will be). Accordingly, caps with lower cap rates are more expensive than caps with higher cap rates.

For a given cap structure (amount protected, duration and cap rate) the cost of the cap premium will fluctuate over time based on changes in market expectations regarding the future path of interest rates and interest rate volatility.

What are the risks of buying a cap?

Loss of premium

A cap provides less risky protection than a swap or a fixed rate. This is because, unlike a swap or a fixed rate, a cap does not expose the borrower to the risks of adverse floors.

The worst that can happen is the buyer pays the premium for the cap but does not receive any payments from it, for example if the floating interest rate stays below the cap rate for the life of the instrument.

Provided that the cap premium has been paid, there can never be a penalty to exit a cap early. The cap’s early redemption value will always be positive or zero. The early redemption value of a cap tends to decline as time passes.